estate tax changes in reconciliation bill

Current law provides that the individual estate and gift tax exemption will be reduced to 5000000 adjusted. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500.

How The Tcja Tax Law Affects Your Personal Finances

On September 12 2021 the House Ways and Means Committee introduced proposed tax changes to be incorporated in the budget reconciliation bill known as the.

. At the same time the bill would raise taxes substantially for those making 1 million or more according to a new analysis by the Tax Policy Center. 107-16 among other tax cuts provided for a gradual reduction and elimination of the estate tax. A 5 surtax on individual income in excess of 10 million per year with an additional 3 on income in excess of 25 million.

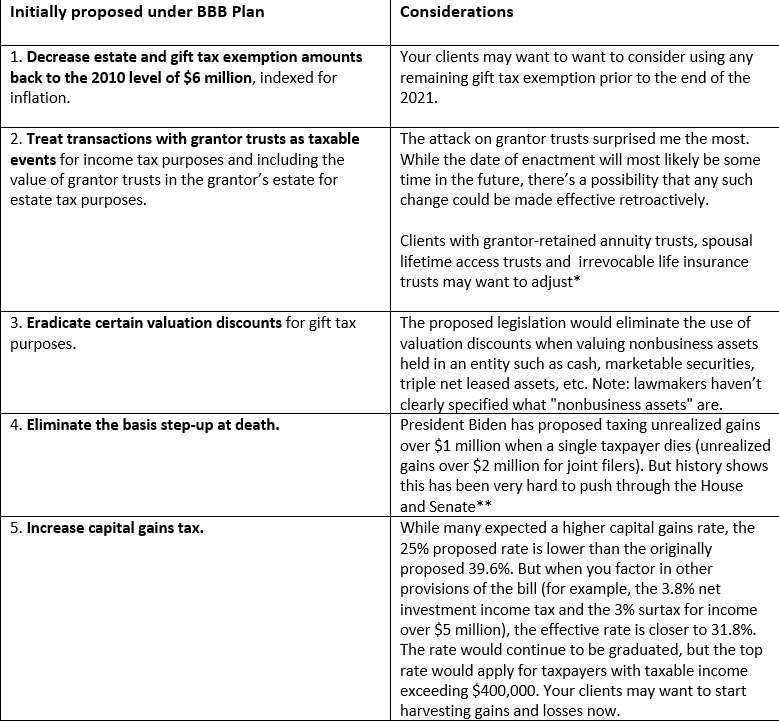

The Legislation includes significant tax proposals that if passed will dramatically change the tax and estate planning landscape for high-income and high-net worth individuals. Individual rate increases. Estate and Gift Tax Exemption.

The BBB bill does include some changes to income tax such as an additional taxes for large corporations and high-income individuals ie taxpayers with an adjusted gross. The Senate is expected to make changes to the bill including repealing the 10000 SALT cap deduction for certain taxpayers with income. While it is uncertain whether any of these.

The proposal reduces the exemption from estate and gift taxes from. Estate and gift tax exemption. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

Instead it contains three primary changes affecting estate and gift taxes. Currently an individual can have an estate of up to 117 million without incurring any federal gift or estate tax 234 million for married couples. The amended change would raise the cap to.

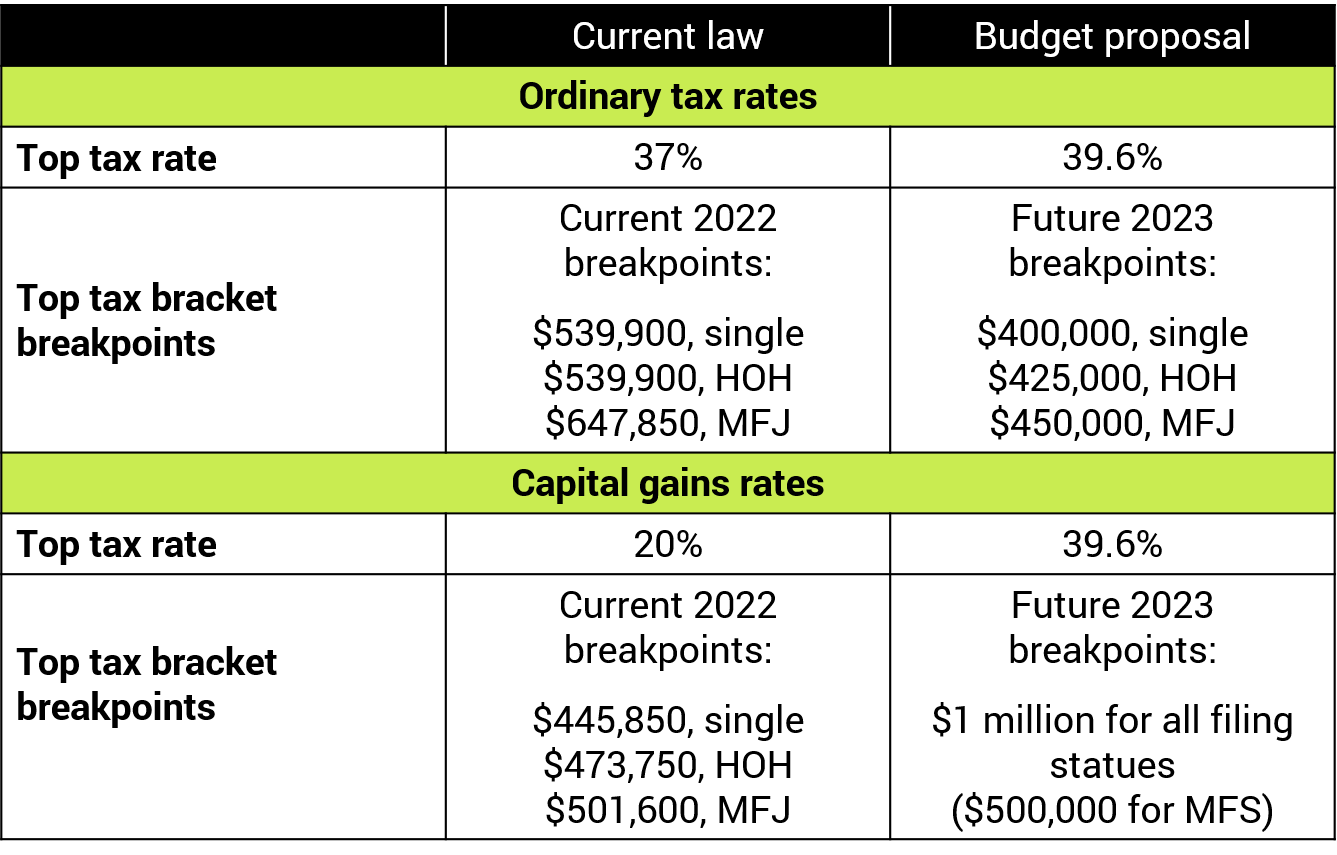

Increasing Tax Rates for Trusts and Estates. No Changes to the Current Gift and Estate Exemption Provisions Until 2025. An individual rate increase to 396 and top capital gains rate increase to 25 as proposed in the Ways and Means bill are doubtful since Sen.

The estate tax exemption would be reduced as of January 1 2022 from its current 117 million to. The current 117M 1 estate and gift tax exclusion was provided under a temporary law. Last week the House Ways and Means Committee released a draft of proposed tax law changes to include in a reconciliation bill.

The Build Back Better Framework released. The 117M per person gift and estate tax exemption will remain in place and will be increased. The clock would start after Dec.

Even without any act of Congress the exclusion will be cut in half effective. Federal estate and gift tax are assessed at a flat rate of 40. If the bill passes impacted IRA owners will have two years to make the change or face full taxation of all assets in the IRA.

Although these prior major tax proposals are not. The bill provides that taxpayers with AGI of 400000 or more and all trusts and estates would only be allowed to exclude 50 of the eligible gain. On November 1 2021 the House Rules Committee reported out the Build Back Better Act Reconciliation Bill which leaves out most of the proposed changes to the estate tax.

Here are some changes the budget reconciliation tax law would bring about. This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. Growth and Tax Relief Reconciliation Act of 2001 EGTRRA.

Under the proposal for tax year 2022 individuals could face a 464 combined tax rate on ordinary income a 396 ordinary rate plus 38 net investment income tax or self. Next Steps for the Reconciliation Bill. The revised version of the bill however does not include these provisions restricting the use of valuation discounts.

The latest draft of the US Congress budget reconciliation Bill omits most of the previously proposed tax changes that would have affected US estate planning.

Estate Tax Law Changes What To Do Now

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

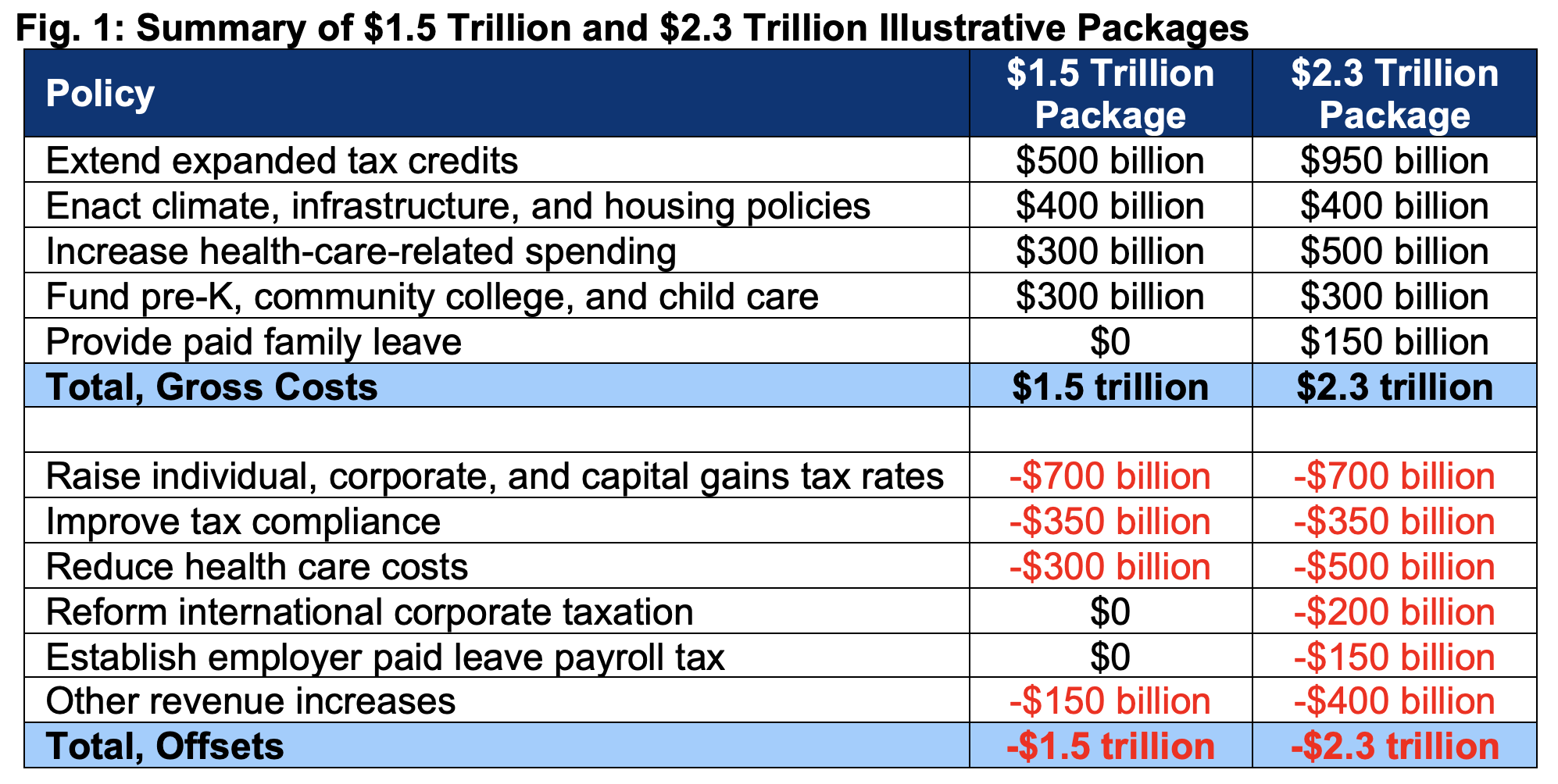

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Proposed Tax Law Changes Which May Impact You Certilman Balin

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The New Death Tax In The Biden Tax Proposal Major Tax Change

Saudi Arabia 2021 Article Iv Consultation Press Release And Staff Report In Imf Staff Country Reports Volume 2021 Issue 149 2021

Tpc The Ways Means Reconciliation Bill Would Raise Taxes On High Income Households Cut Taxes On Average For Nearly Everyone Else

What Happened To The Expected Year End Estate Tax Changes

Real Estate Breathes A Sigh Of Relief As Proposed Changes To Section 1031 And To The Step Up In Basis Are Absent From Current Reconciliation Bill Legal 1031

Law No 7338 Brings Significant Tax Changes To Turkey

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

House Democrats Tax On Corporate Income Third Highest In Oecd

Investment Club Partnership Agreement Legal Forms Template Printable Purchase Agreement

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management